Before the advent of cloud servers, companies that performed due diligence for various types of transactions used physical data rooms to meet and examine the document, as this was the only way to ensure the integrity and security of sensitive data. However, with the advent of dataroom due diligence, everything changed, checks became available digitally remotely, and all data was securely encrypted and protected from external threats. But just having a VDR is not enough for a successful business transaction, and in this article, we will tell you about the most common mistakes when using this space.

Lack of documents ready for due diligence

All of the documentation necessary to perform due diligence should always be prepared in advance, as this data must go through your due diligence phase. This will then save you a lot of time in finding the necessary document.

Different companies have their ways of handling different types of files, and some of them need to keep the version of the document up to date. You should know your data structure like the back of your hand so you don’t hesitate to locate your latest financial statements, insurance policies, intellectual property asset lists, etc.

Unclear naming of your files can lead to serious hiccups and problems, and many ignorant organizations sin in this way. Identifying and forming an intuitive folder and subfolder structure with a clear name is part of planning for VDR due diligence.

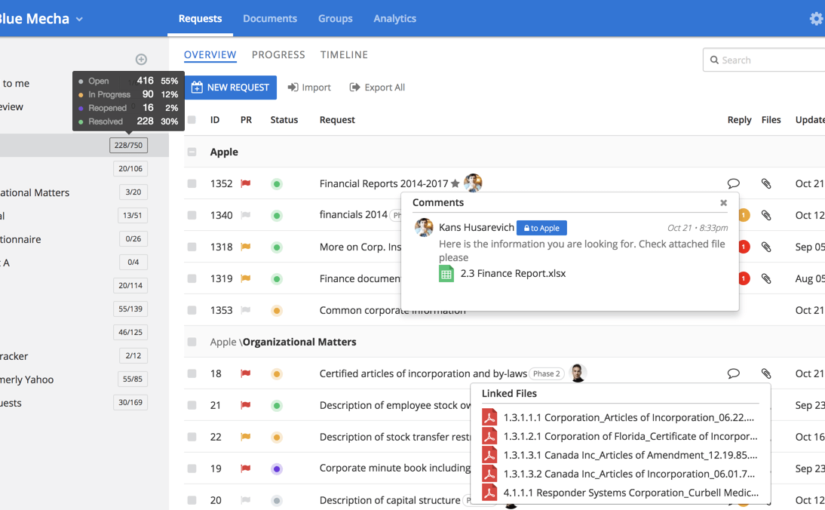

Inadequate management of access permissions in virtual due diligence

Before inviting temporary users into your space, you must decide which digital permission tools you want to use. To make the right decision, you will need to dedicate some time to learn how to use your VDR so that you can know exactly how to give rights to users and how to revoke them. This is important because it affects the confidentiality of your documents and prevents various inconsistencies and confusion.

Also, you need to have an NDA during the transaction to ensure that your business and information are protected, especially if you are doing a merger with your competitor.

File sharing outside of your virtual data room

There are often when data room due diligence involves document sharing. At such times, it’s important to be responsive and attentive to the needs of the organization that is reviewing the information.

At the same time, you must follow a strict disclosure standard. This standard requires requests to be made in writing only. A well-formed agreement and non-disclosure will protect your business, but you should also remember to keep records of correspondence with the third party. Exchanging files outside of the VDR is also forbidden, only in the rarest of exceptions are you allowed to do so.

Also, you should not avoid additional advice and help from professionals, you can hire outside legal counsel to help you form a proper disclosure schedule.

Not telling the whole truth

If you don’t want to deal with litigation, then your team should avoid understatements and dishonesty. Of course, regulations prohibit outright lies in data during an audit, but a common mistake is to exaggerate or downplay figures or projections, and it is disastrous not to do so.

If your potential partners have the impression of incomplete information or any inaccuracy, the transaction will fail, and your company will acquire a reputation for being disorganized or secretive, which of course will alienate others. The data you enter into the VDR must be current and accurate.